Emerging Markets: Key Investment Prospects for 2024

Understanding Emerging Markets and Their Potential

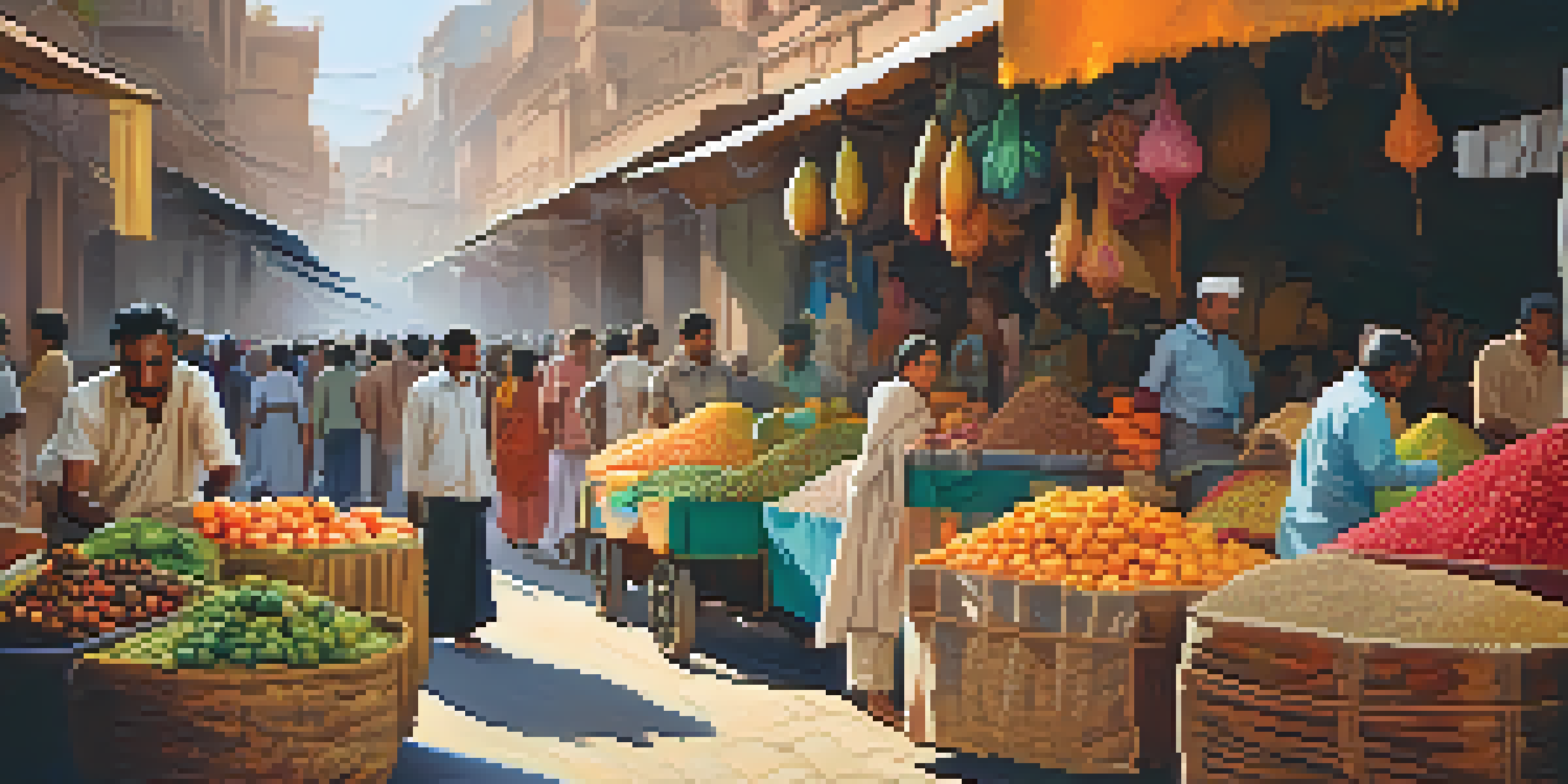

Emerging markets are economies that are in the process of rapid growth and industrialization. They often present unique investment opportunities due to their potential for high returns compared to developed markets. Countries like Brazil, India, and Vietnam exemplify this trend, showcasing both challenges and rewards for investors.

In investing, what is comfortable is rarely profitable.

The appeal of these markets lies in their young populations, increasing consumer demand, and ongoing infrastructure development. For instance, India's tech sector is booming, driven by a large, youthful workforce and burgeoning digital adoption. This combination creates a fertile ground for investment across various sectors.

However, investing in emerging markets is not without risks, including political instability and currency fluctuations. It's essential for investors to conduct thorough research and consider local insights to navigate these challenges effectively. Understanding the nuances of each market can make a significant difference in investment success.

Key Economic Indicators to Watch in 2024

When assessing emerging markets, specific economic indicators can provide valuable insights into their potential. Key metrics include GDP growth rates, inflation rates, and employment figures. For example, a consistent increase in GDP often signals a strong economic environment conducive to investment.

In 2024, investors should keep an eye on inflation rates, as rising prices can erode purchasing power and impact consumer spending. Countries like Turkey have faced this challenge, where high inflation has led to economic instability. Understanding these trends can help investors make informed decisions.

Investment Potential in Emerging Markets

Emerging markets like India and Brazil offer unique investment opportunities due to rapid growth and industrialization.

Moreover, the employment landscape is crucial; a growing job market typically indicates a healthy economy. Monitoring these indicators allows investors to identify markets with favorable conditions for investment, ultimately leading to better returns.

Sector Spotlight: Technology in Emerging Markets

The technology sector is a standout in many emerging markets, driving innovation and economic growth. Countries like India and Brazil have seen a surge in tech startups, fueled by a growing demand for digital solutions. This sector's expansion offers numerous investment opportunities, from software development to e-commerce.

Emerging markets are not just places to invest; they are places to innovate, to disrupt, and to create a better future.

In 2024, the emphasis on digital transformation is expected to continue, with emerging markets investing heavily in tech infrastructure. For instance, internet penetration and mobile connectivity are rapidly increasing, providing a larger consumer base for tech companies. Investors should consider these factors when exploring potential investments.

Additionally, the rise of fintech in emerging markets is notable, as it provides financial services to unbanked populations. Platforms like M-Pesa in Kenya showcase how technology can revolutionize access to finance, presenting a compelling case for investment in the tech sector.

The Role of Sustainable Investments

Sustainable investing is gaining traction in emerging markets, reflecting a global shift towards environmentally conscious practices. Investors are increasingly looking for opportunities that align with social and environmental goals, making sustainability a key consideration. Countries like South Africa are leading the way in renewable energy initiatives, attracting investment.

In 2024, sustainable investments could offer a dual benefit: financial returns and a positive impact on local communities. Projects in renewable energy, waste management, and sustainable agriculture are not only profitable but also contribute to long-term environmental stability. This trend is reshaping how investors approach opportunities in emerging markets.

Key Economic Indicators to Monitor

Tracking GDP growth, inflation, and employment rates is essential for identifying favorable investment conditions in 2024.

Moreover, companies that embrace sustainability often see improved brand loyalty and customer engagement. Investors should look for businesses that prioritize sustainability, as they may have a competitive edge in the evolving global market.

Political Stability and Investment Climate

Political stability is a crucial factor influencing investment decisions in emerging markets. Investors must assess the political landscape to gauge potential risks and rewards. Countries with stable governments and democratic frameworks tend to create more favorable conditions for investment.

In 2024, markets like Indonesia are expected to maintain political stability, which can foster a more predictable investment climate. Conversely, nations facing political turmoil, such as Venezuela, pose higher risks for investors, making thorough due diligence essential. Understanding local politics can help investors navigate these complexities.

Engaging with local experts and utilizing resources like political risk assessments can provide valuable insights. By paying attention to the political environment, investors can make more informed decisions and mitigate potential risks associated with emerging markets.

Currency Risks and How to Manage Them

Currency fluctuations can significantly impact investments in emerging markets, making it essential for investors to understand and manage these risks. In 2024, currencies like the Brazilian real or the Indian rupee may experience volatility due to various economic factors, including interest rates and trade policies. This can affect the returns on investments made in these currencies.

To mitigate currency risks, investors can consider hedging strategies, such as forward contracts or options. These financial instruments allow investors to lock in exchange rates, providing some protection against adverse currency movements. Understanding these tools can help investors safeguard their investments.

Focus on Sustainable Investments

Sustainable investing is gaining momentum, with opportunities in renewable energy and tech that align with social and environmental goals.

Additionally, diversifying investments across different currencies can reduce exposure to any single currency's fluctuations. By spreading investments across multiple emerging markets, investors can achieve a more balanced and resilient portfolio, ultimately enhancing their chances of success.

Conclusion: Navigating Investment Opportunities in 2024

As we look toward 2024, emerging markets present a wealth of investment prospects that savvy investors should not overlook. Understanding the unique dynamics of each market, from economic indicators to political stability, is crucial for success. By doing so, investors can identify opportunities that align with their financial goals.

Moreover, sectors like technology and sustainable investments offer exciting avenues for growth, reflecting broader global trends. With the right strategies in place, including managing currency risks and conducting thorough research, investors can position themselves favorably in these markets.

Ultimately, the key lies in staying informed and adaptable. By keeping a close eye on emerging trends and being open to new opportunities, investors can navigate the complexities of emerging markets and capitalize on their potential for significant returns in 2024.