Understanding the Ethical Landscape of Impact Investing

What is Impact Investing and Its Purpose?

Impact investing is a strategy that aims to generate measurable social and environmental benefits alongside financial returns. This approach goes beyond traditional investing by focusing on initiatives that have a positive impact on society. For instance, an investor might choose to fund renewable energy projects, believing that profits can coexist with sustainability.

Investing is not just about making money. It’s about making a difference.

At its core, impact investing seeks to solve pressing global issues, such as poverty, climate change, and educational disparities. Investors are not only looking for profits; they want to make a difference in the world. This dual focus has led to a growing community of investors who prioritize ethical considerations in their financial decisions.

By aligning their investments with personal values, impact investors can contribute to positive change while still securing a return on their investment. This ethical dimension adds richness to the investing experience, making it more than just a numbers game.

The Ethical Implications of Impact Investing

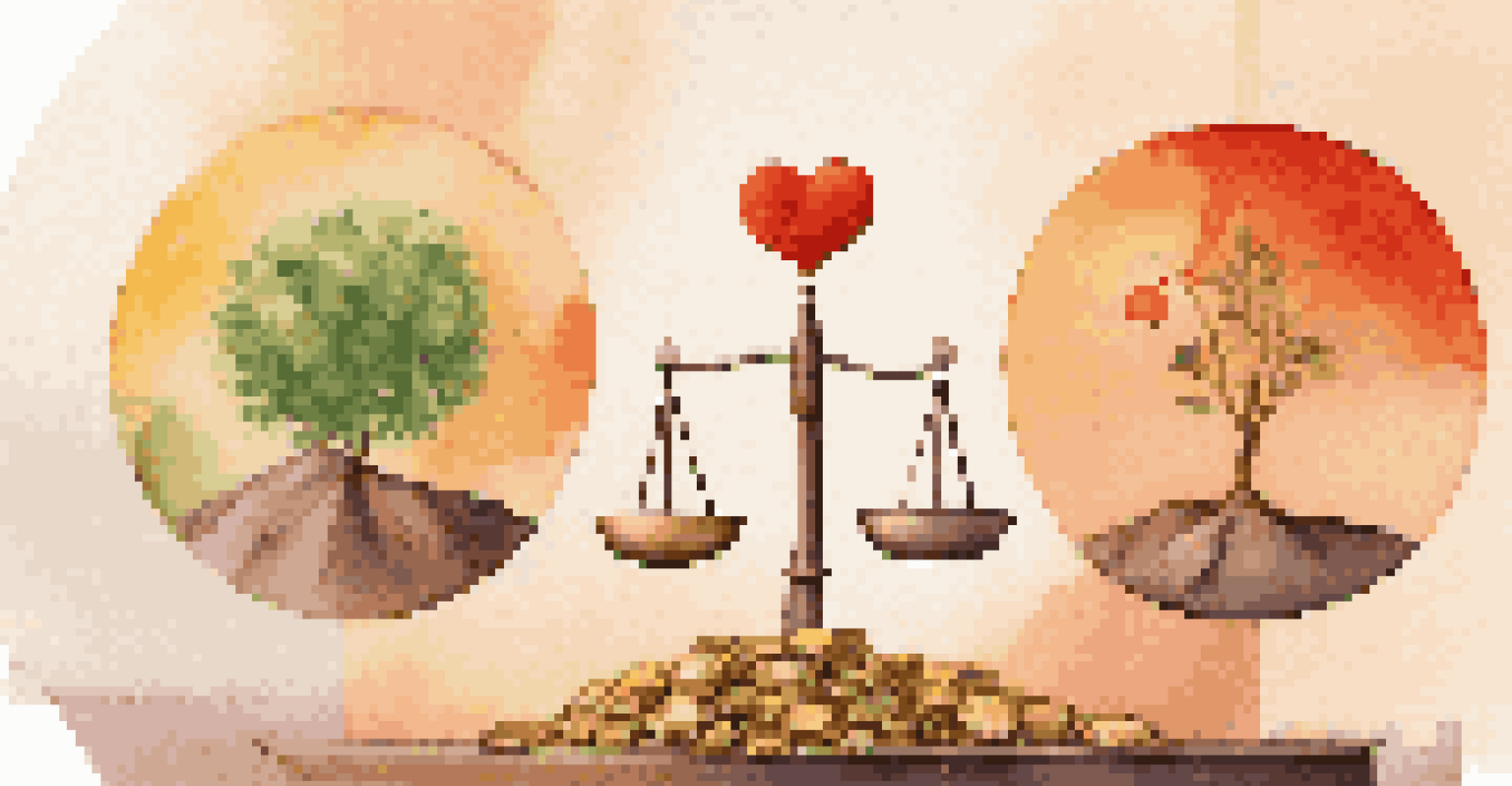

Ethics play a crucial role in impact investing, as investors must navigate the fine line between profit and purpose. It raises questions about what constitutes a 'good' investment and how to measure success. For example, does a company that provides essential services in low-income areas, but has questionable labor practices, still qualify as a positive impact investment?

These dilemmas highlight the necessity of transparency and accountability in the impact investing landscape. Investors need to understand the potential trade-offs between social good and financial gain. This awareness helps them make informed decisions that align with their ethical standards.

Impact Investing Aims for Dual Benefit

Impact investing seeks to generate financial returns while also addressing social and environmental challenges.

Moreover, the growing demand for ethical investments has prompted organizations to create frameworks and standards for evaluating impact. This movement aims to foster a more responsible investment environment where ethical considerations are at the forefront of decision-making.

Measuring Impact: The Challenge Ahead

One of the biggest challenges in impact investing is measuring the actual impact of investments. Unlike financial returns, social and environmental benefits can be subjective and difficult to quantify. For example, how do you measure the success of a community health initiative beyond just the number of patients treated?

The best way to find yourself is to lose yourself in the service of others.

Various methodologies are being developed to assess impact effectively, including frameworks like the Global Impact Investing Network's IRIS metrics. These tools aim to provide standardized measurements to evaluate the success of investments in achieving their intended outcomes. However, the debate over which metrics to use continues, as different investors may prioritize different impacts.

Ultimately, the challenge of measuring impact requires ongoing dialogue and collaboration among investors, organizations, and communities. By sharing best practices and learning from one another, the impact investing community can improve its ability to assess and enhance the benefits of their investments.

The Role of Transparency in Ethical Investing

Transparency is essential in impact investing, as it fosters trust between investors and the organizations they support. Investors need clear information about how their funds are being utilized and the impact they are generating. Without transparency, skepticism can arise, leading to potential disengagement from the investment community.

Organizations that embrace transparency can provide investors with regular updates on their projects, financial performance, and social impact. By doing so, they not only build credibility but also encourage ongoing support from their investors. This open communication leads to a more engaged investor community that feels connected to the mission.

Ethics and Transparency are Crucial

Investors must navigate ethical dilemmas and ensure transparency to build trust and make informed decisions.

Moreover, transparency can drive better decision-making, as it allows investors to align their portfolios with their ethical values. This alignment enhances the overall integrity of the impact investing space, ensuring that investors can feel good about where their money is going.

Balancing Profit and Purpose in Investments

Finding the right balance between profit and purpose can be challenging for impact investors. The expectation of financial returns often clashes with the desire to support initiatives that prioritize social good. For instance, an investor might struggle with whether to invest in a high-profit tech company or a lower-return social enterprise.

This balancing act requires critical thinking and a clear understanding of individual values and goals. By establishing personal criteria for investment, investors can better navigate these tough choices. It’s about finding opportunities that resonate with their ethical beliefs while still achieving financial growth.

Ultimately, investors must recognize that the landscape of impact investing is ever-evolving. As more options become available, the potential for aligning profit and purpose will only increase, paving the way for innovative investment strategies.

The Future of Ethical Impact Investing

The future of impact investing looks promising, with an increasing number of investors seeking ethical options. As awareness of social and environmental issues grows, individuals and organizations are more inclined to invest in projects that align with their values. This trend is likely to continue, shaping the investment landscape for years to come.

Moreover, the rise of technology and data analytics is transforming how investors assess impact. New tools are emerging that provide richer insights into both financial and social returns. This advancement will enable investors to make more informed decisions, contributing to a more significant shift in the industry.

Measuring Impact Remains Complex

Determining the true impact of investments is challenging, requiring ongoing dialogue and standardized metrics.

As the conversation around impact investing continues to evolve, it will encourage more collaboration between investors, enterprises, and communities. This synergy will ultimately help drive positive change, ensuring that ethical considerations remain central to the investment process.

Conclusion: The Importance of Ethical Considerations

In conclusion, understanding the ethical landscape of impact investing is crucial for anyone looking to make a difference through their financial decisions. As investors, recognizing the implications of their choices can lead to more responsible and impactful investments. The journey of balancing profit and purpose is not only rewarding but also essential in today’s world.

By prioritizing transparency, measurement, and ethical considerations, investors can contribute to positive change while achieving their financial goals. The ongoing dialogue about ethics in impact investing will continue to shape the future of this field, encouraging more individuals to participate.

Ultimately, impact investing is about aligning financial success with meaningful outcomes. As awareness grows, so does the potential for creating a better world, one investment at a time.