Understanding Candlestick Patterns: A Guide for Beginners

What Are Candlestick Patterns and Why They Matter

Candlestick patterns are visual representations of price movements in financial markets, typically used in trading. Each 'candlestick' displays four key pieces of information: the open, high, low, and close prices for a specific time period. Understanding these patterns can help traders make informed decisions, as they often indicate market trends.

The market is a device for transferring money from the impatient to the patient.

For example, a single candlestick can show whether buyers or sellers were in control during that time frame. By observing these patterns over time, traders can identify potential reversals or continuations in price trends. This insight is crucial for anyone looking to navigate the sometimes turbulent waters of trading.

Ultimately, mastering candlestick patterns can enhance your trading strategy, contributing to better risk management and increased profitability. Whether you're a day trader or a long-term investor, knowing how to read these patterns effectively can give you a significant advantage.

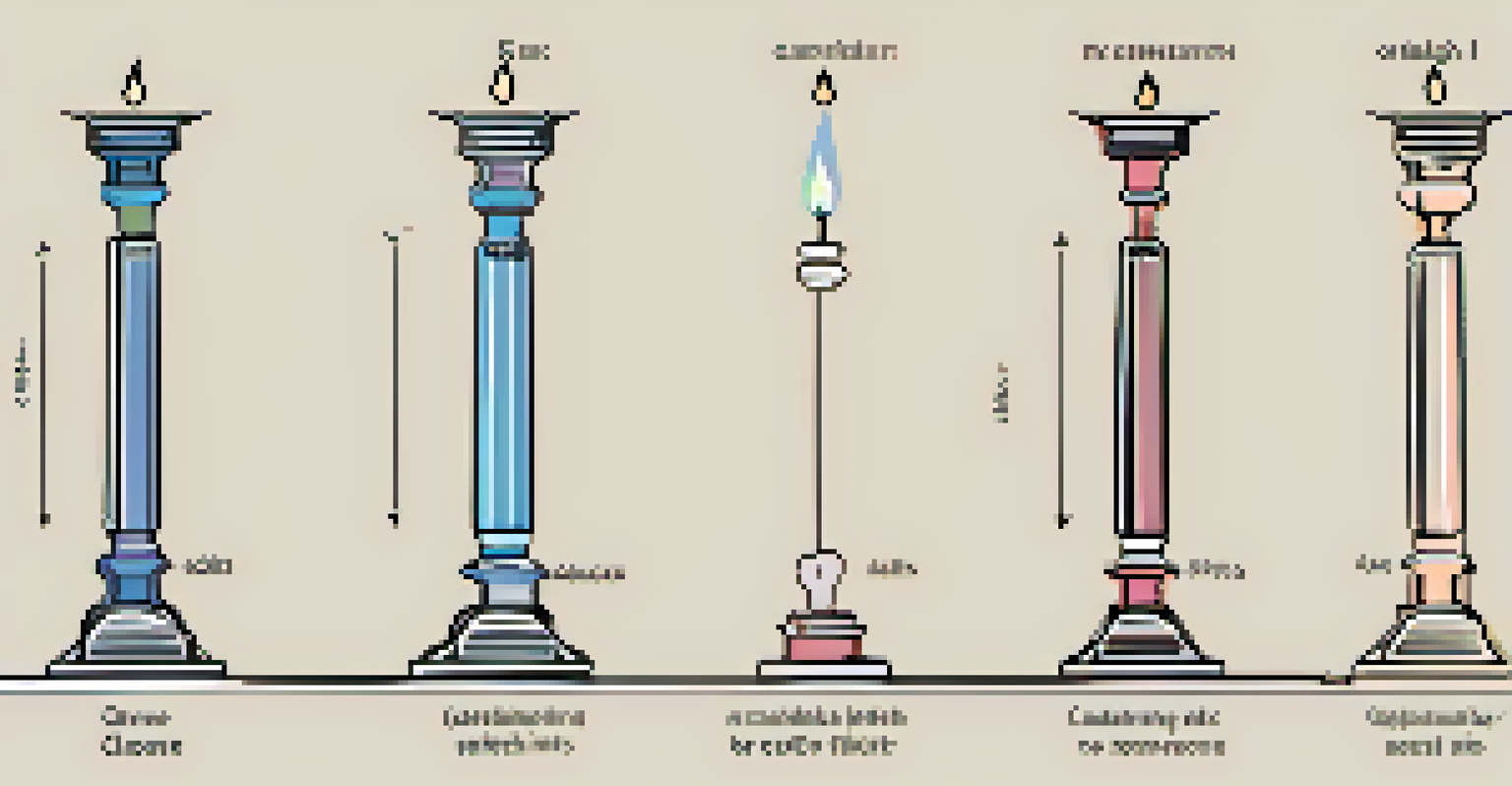

Basic Components of a Candlestick

To understand candlestick patterns, it's essential to know their basic components. Each candlestick consists of a body and shadows (or wicks), which represent the range of price movement during the given time period. The body shows the opening and closing prices, while the shadows indicate the highest and lowest prices reached.

For instance, a green (or white) candlestick signifies that the closing price was higher than the opening price, suggesting bullish sentiment. Conversely, a red (or black) candlestick indicates that the closing price was lower than the opening price, hinting at bearish sentiment. These color codes are valuable for quickly assessing market dynamics.

Understanding Candlestick Basics

Candlestick patterns visually represent price movements, helping traders assess market trends and make informed decisions.

By familiarizing yourself with these components, you'll gain a clearer understanding of how to interpret candlestick patterns. This knowledge serves as the foundation for recognizing more complex patterns and making educated trading decisions.

Common Candlestick Patterns to Recognize

There are several common candlestick patterns that traders often look for in the market. Some of the most popular include the Doji, Hammer, and Engulfing patterns. Each of these patterns has its own implications and can signal potential market reversals or continuations.

In investing, what is comfortable is rarely profitable.

For example, a Doji candlestick appears when the opening and closing prices are nearly the same, indicating indecision in the market. On the other hand, a Hammer pattern typically appears at the bottom of a downtrend and suggests that buyers may be gaining strength. Recognizing these patterns can help traders anticipate future price movements.

By honing your ability to identify these common patterns, you'll be better equipped to make timely and informed trading decisions. This skill can significantly enhance your overall trading strategy, allowing for more successful outcomes.

Interpreting Candlestick Patterns in Context

While candlestick patterns provide valuable insights, it's crucial to interpret them in context. This means considering other factors, such as market trends, volume, and economic events, which can significantly influence price movements. A candlestick pattern alone may not provide a complete picture of the market's behavior.

For example, a bullish pattern might appear in a strong uptrend, suggesting a continuation of the trend, while the same pattern in a downtrend could indicate a potential reversal. Additionally, analyzing the volume alongside candlestick patterns can give traders further confirmation of the strength or weakness of a price movement.

Importance of Context in Trading

Interpreting candlestick patterns requires considering market trends, volume, and economic events to avoid misleading signals.

Thus, combining candlestick analysis with other market factors creates a more robust trading strategy. This comprehensive approach helps traders make better-informed decisions and reduces the risk of false signals.

Using Candlestick Patterns with Other Indicators

Integrating candlestick patterns with other technical indicators can enhance your trading strategy. For instance, combining candlestick analysis with moving averages, Relative Strength Index (RSI), or MACD can provide more confirmation for your trades. This multi-faceted approach helps to validate the signals generated by candlestick patterns.

Consider a scenario where a bullish engulfing pattern forms near a significant support level, coinciding with an oversold RSI reading. This convergence of signals can indicate a strong buying opportunity. Conversely, if a bearish pattern appears alongside a declining moving average, it may suggest a strengthening downtrend.

By leveraging multiple indicators, you can improve your chances of success in trading. This strategy not only provides greater confidence in your decisions but also helps to mitigate potential losses.

Practical Tips for Beginners Using Candlestick Patterns

As a beginner, there are several practical tips to keep in mind when learning to use candlestick patterns. First, practice identifying these patterns on historical charts to build your confidence. Many trading platforms offer demo accounts where you can experiment without risking real money, making it an ideal environment for learning.

Second, focus on a few key patterns initially, such as the Doji and Hammer, before expanding your knowledge. Mastering a handful of patterns can give you a solid foundation, making it easier to recognize and interpret more complex formations later on. Gradually integrating new patterns into your trading strategy can enhance your skills without overwhelming you.

Combining Indicators for Success

Integrating candlestick patterns with other technical indicators enhances trading strategies and improves decision-making confidence.

Lastly, remain patient and disciplined as you learn. Developing proficiency in reading candlestick patterns takes time and practice. By committing to continuous improvement, you'll gradually increase your confidence and effectiveness as a trader.

Avoiding Common Mistakes in Candlestick Trading

Many beginners fall into common traps when trying to trade based on candlestick patterns. One prevalent mistake is overreacting to single candlestick signals without considering the bigger picture. It's important to remember that patterns should be analyzed in conjunction with broader market trends and other indicators to avoid false signals.

Another common error is ignoring the importance of volume. A candlestick pattern accompanied by low volume may not carry the same weight as one with high volume, which can indicate stronger conviction among traders. Always assess the volume when interpreting candlestick patterns for more reliable trading decisions.

By being aware of these common pitfalls, you can refine your trading strategy and minimize the likelihood of costly mistakes. Developing a disciplined approach and adhering to sound trading principles will set you on the path to success.