The Relationship Between Capital Gains and Market Trends

What Are Capital Gains and Why Do They Matter?

Capital gains refer to the profit made from the sale of an asset, such as stocks or real estate, when the selling price exceeds the purchase price. Understanding capital gains is crucial for investors because they directly impact the return on investment. When you sell an asset at a higher price, the profit becomes a capital gain, and this can influence your tax obligations as well.

The stock market is filled with individuals who know the price of everything, but the value of nothing.

Investors often monitor capital gains as part of their overall financial strategy, as they can indicate the health of their investments. For instance, if a stock you bought for $50 is now selling for $70, you have a capital gain of $20. This simple calculation can guide decisions about when to sell or hold onto an asset based on market trends.

Moreover, capital gains can reflect broader economic conditions. In a booming market, many investors experience capital gains, which can encourage further investment and stimulate economic activity. Conversely, during market downturns, capital gains may diminish, impacting investor confidence and spending.

How Market Trends Influence Capital Gains

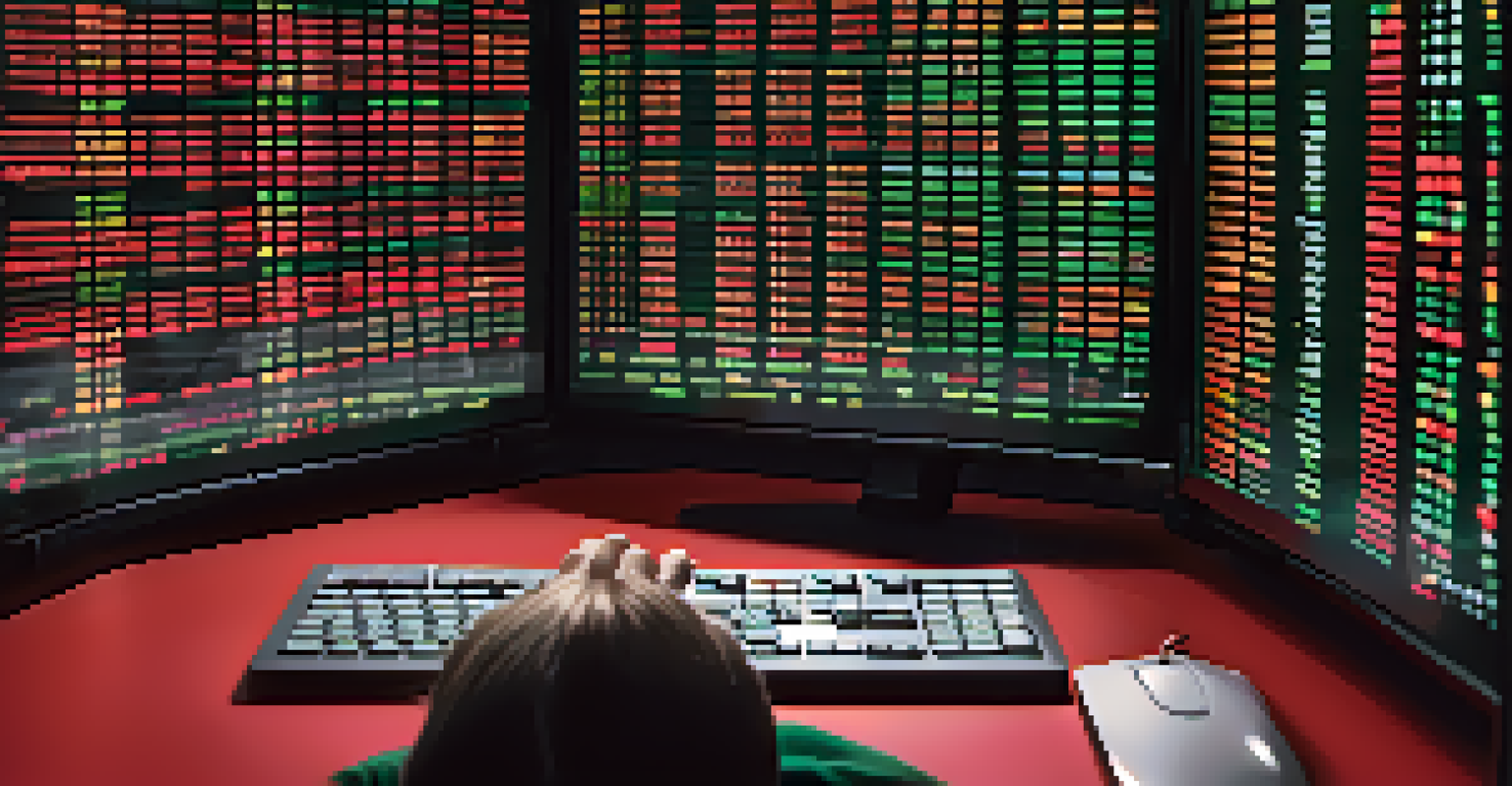

Market trends play a pivotal role in determining the value of assets and, subsequently, capital gains. For instance, during a bull market, where prices are rising, the likelihood of selling assets at a profit increases, resulting in higher capital gains. This creates a positive feedback loop, encouraging more investment as people see their assets appreciating in value.

Conversely, in a bear market, where prices are falling, capital gains can quickly turn into capital losses. Investors may find themselves holding onto assets longer than they planned, hoping for a market rebound. This situation can lead to a more cautious investment approach, as people become wary of potential losses.

Understanding Capital Gains

Capital gains are profits from selling assets at a higher price than their purchase cost, directly affecting investors' returns and tax obligations.

Additionally, market trends can be influenced by various factors, including economic indicators, interest rates, and geopolitical events. For example, if interest rates rise, borrowing costs increase, which can slow down economic growth and negatively impact stock prices. Understanding these dynamics helps investors anticipate how market fluctuations might affect their capital gains.

Types of Capital Gains: Short-Term vs. Long-Term

Capital gains can be categorized into two main types: short-term and long-term. Short-term capital gains occur when an asset is sold within a year of purchase and are typically taxed at ordinary income tax rates, which can be quite high. This is important for investors to consider, as frequent trading can lead to higher tax liabilities.

In investing, what is comfortable is rarely profitable.

Long-term capital gains, on the other hand, apply to assets held for more than a year. These gains are usually taxed at lower rates, encouraging investors to hold onto their investments longer, which can support market stability. This distinction can influence how investors approach their portfolios and make decisions on buying or selling assets.

By understanding the differences between short-term and long-term capital gains, investors can better strategize their buying and selling. For instance, if an investor knows that their asset will likely appreciate over several years, they may choose to hold on and benefit from the lower long-term tax rate.

The Role of Economic Indicators in Capital Gains

Economic indicators, such as GDP growth, unemployment rates, and inflation, provide insight into the overall health of the economy and can influence capital gains. When economic indicators signal growth, investors are often more optimistic, which can lead to increased stock prices and capital gains. For example, a rising GDP often suggests that businesses are thriving, which can drive up share prices.

Conversely, negative economic indicators, like high unemployment or rising inflation, can dampen investor sentiment. When confidence wanes, stock prices may fall, leading to potential capital losses instead of gains. Investors who stay informed about these indicators can adjust their strategies to mitigate risks.

Market Trends Impact Gains

Market trends, influenced by economic factors, play a crucial role in determining asset values and can lead to significant capital gains or losses.

Moreover, understanding how to read these indicators can empower investors to make informed decisions about when to buy or sell. For instance, if an investor sees that inflation is rising sharply, they may choose to sell certain assets to avoid potential losses as market conditions shift.

Investment Strategies for Maximizing Capital Gains

To maximize capital gains, investors often employ various strategies tailored to their financial goals and risk tolerance. One common approach is the buy-and-hold strategy, where investors purchase assets and hold them for an extended period, allowing time for appreciation. This strategy aligns well with the long-term capital gains tax benefits and can yield substantial returns when market conditions are favorable.

Another strategy is the timing of sales, often guided by market trends and economic indicators. Savvy investors may closely monitor market conditions to identify optimal selling points, maximizing their capital gains. For example, selling during a market peak can significantly enhance profits compared to selling during a downturn.

Additionally, diversification plays a crucial role in managing risk while pursuing capital gains. By spreading investments across various asset classes, such as stocks, bonds, and real estate, investors can potentially safeguard against market volatility and maintain a more stable growth trajectory for their capital gains.

Tax Implications of Capital Gains

Understanding the tax implications of capital gains is essential for effective financial planning. Short-term capital gains are taxed at ordinary income tax rates, which can range from 10% to 37% depending on your income bracket. This can significantly impact your overall returns, making it crucial to consider the tax consequences of your investment strategy.

Long-term capital gains, however, benefit from lower tax rates, typically ranging from 0% to 20%, depending on your income level. This tax advantage encourages investors to hold onto assets longer, potentially resulting in greater wealth accumulation. Knowing these rates can help investors time their sales to optimize tax outcomes.

Tax Strategies for Gains

The distinction between short-term and long-term capital gains tax rates is vital for investors, as it can significantly impact their overall returns.

Additionally, tax-loss harvesting is a strategy some investors use to offset capital gains with losses from other investments. By selling underperforming assets at a loss, investors can reduce their overall tax burden, making it a valuable tool for managing capital gains tax liabilities.

Future Trends: What to Expect for Capital Gains

Looking ahead, several trends are likely to shape the landscape of capital gains. Factors like technological advancements, changing consumer behavior, and shifts in global economic power can all influence market dynamics and, consequently, capital gains. For instance, the rise of technology stocks has dramatically altered the investment landscape, leading to significant capital gains for early investors.

Additionally, environmental, social, and governance (ESG) investing is gaining traction, with many investors prioritizing sustainability. As more funds flow into socially responsible companies, capital gains in this sector may rise, reflecting a shift in market demand. This trend can create new opportunities for investors looking to align their portfolios with their values.

Understanding these future trends can help investors stay ahead of the curve. By adapting their strategies in response to emerging market conditions and societal shifts, investors can position themselves for potential capital gains in a rapidly changing economic environment.