Asset Allocation Techniques for High-Net-Worth Investors

Understanding Asset Allocation for Wealth Management

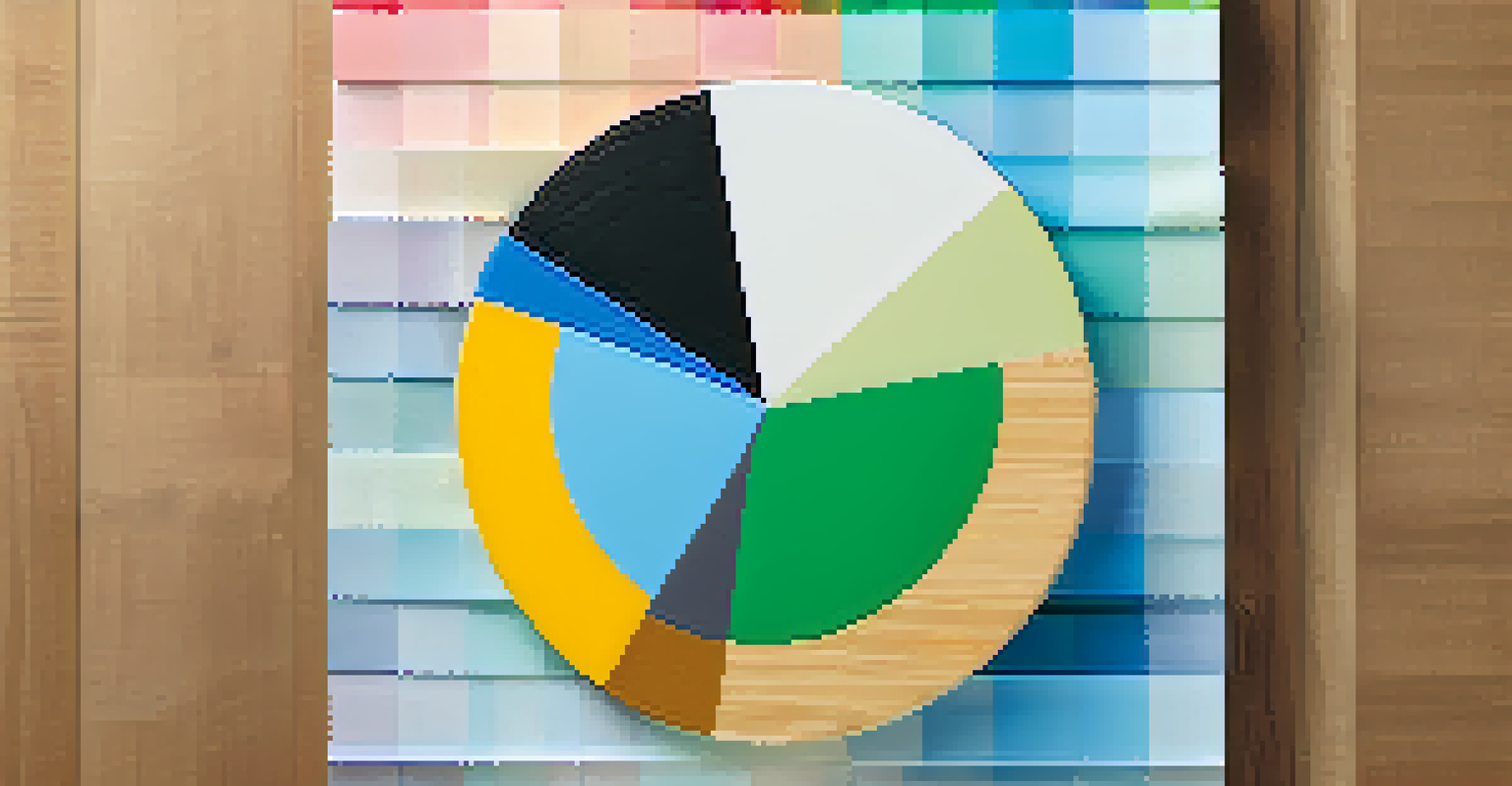

Asset allocation is the process of dividing an investment portfolio among different asset categories, such as stocks, bonds, and real estate. For high-net-worth investors, this strategy is crucial as it helps manage risk while pursuing growth. By diversifying investments, these individuals can mitigate losses during market downturns, ensuring their wealth is protected.

In investing, what is comfortable is rarely profitable.

Think of asset allocation like a well-balanced meal: you wouldn't want to fill your plate with just one food group. Similarly, a diverse investment portfolio helps to balance risk and return. High-net-worth investors need to consider their unique financial goals, risk tolerance, and time horizon when determining their ideal asset mix.

In essence, effective asset allocation serves as the foundation for a solid investment strategy. It allows wealthy individuals to tailor their portfolios to meet specific objectives, whether that's capital preservation or aggressive growth, making it a vital component of wealth management.

Key Factors Influencing Asset Allocation Decisions

Several factors influence how high-net-worth investors allocate their assets, including age, income level, and investment goals. Younger investors may lean towards riskier assets like equities to maximize growth potential, while those nearing retirement might prioritize safer investments like bonds. Understanding these factors is essential for creating a tailored asset allocation strategy.

Market conditions also play a significant role in asset allocation decisions. For instance, in a bull market, investors might feel more confident allocating a larger portion to stocks, while in a bear market, they may shift towards more defensive assets. Staying informed about economic trends helps high-net-worth individuals make timely adjustments to their portfolios.

Importance of Asset Allocation

Asset allocation is crucial for high-net-worth investors as it helps manage risk while pursuing growth through a diversified investment portfolio.

Lastly, tax considerations can impact asset allocation as well. High-net-worth investors should be mindful of how different investments are taxed, as it can influence their overall returns. By incorporating tax-efficient strategies into their asset allocation plan, they can enhance their financial outcomes.

The Role of Risk Tolerance in Asset Allocation

Risk tolerance is a key component of asset allocation that varies from one investor to another. It reflects an individual's willingness and ability to endure market fluctuations. High-net-worth investors often have a higher risk tolerance due to their extensive financial resources, but this doesn't mean they should ignore their comfort levels.

The stock market is filled with individuals who know the price of everything, but the value of nothing.

Assessing risk tolerance involves understanding both emotional and financial factors. For example, an investor may have a stable income yet feel uneasy about losing substantial amounts in the stock market. Balancing emotional responses with financial readiness is crucial in crafting a suitable asset allocation strategy.

Ultimately, aligning asset allocation with risk tolerance helps high-net-worth investors avoid rash decisions during market volatility. By finding a comfortable balance, they can pursue their investment objectives without unnecessary stress, leading to long-term success.

Diversification: A Cornerstone of Asset Allocation

Diversification is often touted as a fundamental principle of investing, and for good reason. By spreading investments across various asset classes, high-net-worth investors can reduce the impact of any single investment's poor performance on their overall portfolio. This strategy is akin to not putting all your eggs in one basket.

For instance, a well-diversified portfolio might include a mix of stocks, bonds, real estate, and alternative investments like private equity or hedge funds. This variety not only mitigates risk but can also enhance returns over time. High-net-worth investors should continuously evaluate their portfolio's diversification to ensure it aligns with their financial goals.

Role of Risk Tolerance

Understanding risk tolerance is essential for high-net-worth investors to align their asset allocation with their comfort levels and financial goals.

Moreover, diversification isn't just about spreading investments; it's also about choosing assets that respond differently to market conditions. By including a mix of asset classes that react differently to economic shifts, investors can create a more resilient portfolio, which is especially important in uncertain times.

Using Strategic Asset Allocation Techniques

Strategic asset allocation involves setting a long-term target mix of assets based on an investor's goals and risk tolerance. This approach typically requires periodic rebalancing to maintain the desired asset allocation as market conditions change. High-net-worth investors benefit from this structured approach, providing clarity in their investment strategy.

An example would be an investor who sets a target of 60% equities and 40% fixed income. Over time, if equities perform well, this allocation may shift to 70% equities and 30% fixed income. Rebalancing allows the investor to sell high and buy low, capitalizing on market fluctuations while adhering to their strategic plan.

Strategic asset allocation not only helps maintain a consistent investment approach but also serves as a guideline for making informed decisions. High-net-worth investors can avoid emotional trading and stay focused on their long-term financial objectives, leading to enhanced portfolio performance.

Tactical Asset Allocation: Flexibility in Action

Tactical asset allocation offers high-net-worth investors a more flexible approach to managing their portfolios. Unlike strategic allocation, which sticks to a predetermined asset mix, tactical allocation allows for short-term adjustments based on market conditions. This technique can be particularly advantageous during periods of volatility or economic shifts.

For instance, if an investor believes that the stock market is poised for a downturn, they might temporarily reduce their equity allocation and increase their exposure to bonds or cash. This proactive approach can help safeguard their wealth against potential losses and capitalize on market opportunities.

Need for Regular Portfolio Review

Periodic review and adjustment of asset allocation strategies ensure that high-net-worth investors stay aligned with their evolving financial objectives and market conditions.

However, tactical asset allocation requires a keen understanding of market trends and economic indicators. High-net-worth investors should stay informed and be prepared to act quickly, ensuring that their investment decisions align with their overall financial strategy while navigating the ever-changing landscape.

The Importance of Periodic Review and Adjustment

Regularly reviewing and adjusting an asset allocation strategy is critical for high-net-worth investors. As life circumstances change—such as retirement, inheritance, or major purchases—their financial goals and risk tolerance may also shift. A periodic review ensures that the portfolio remains aligned with these evolving objectives.

Additionally, economic conditions fluctuate, impacting asset performance and correlation. High-net-worth investors should take into account macroeconomic indicators, market trends, and personal financial changes during these reviews. This proactive approach helps maintain a balanced and effective investment strategy.

Ultimately, a commitment to ongoing assessment fosters resilience in a portfolio. High-net-worth investors who make it a habit to regularly evaluate their asset allocation can better navigate market uncertainties and continue to work toward their financial goals.